DOGE Price Prediction: Technical Breakout and Institutional Momentum Signal Potential Rally to $1

#DOGE

- Technical Breakout Potential: Trading above key moving average with Bollinger Band squeeze suggesting imminent volatility expansion

- Institutional Adoption: Record $6 billion open interest and ETF flows providing structural support

- Price Targets: Analysts identifying $0.54 as key resistance with potential rally to $1.70 upon breakout

DOGE Price Prediction

Technical Analysis: DOGE Shows Bullish Momentum Above Key Moving Average

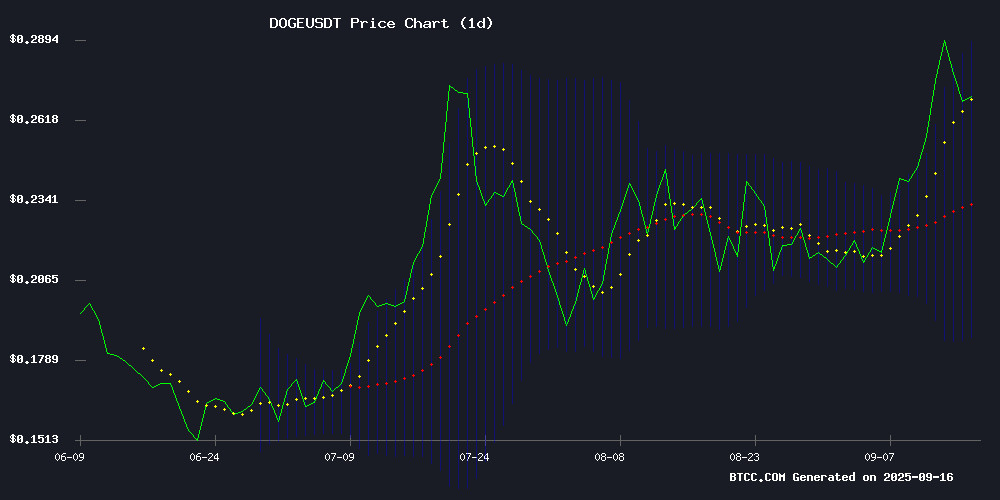

DOGE is currently trading at $0.2649, positioned above its 20-day moving average of $0.2374, indicating underlying bullish momentum. The MACD indicator shows negative values but with the signal line (-0.012074) above the MACD line (-0.024137), suggesting potential trend reversal. Bollinger Bands reveal price trading NEAR the upper band at $0.2879, indicating strong buying pressure. According to BTCC financial analyst Emma, 'The technical setup suggests DOGE is testing resistance levels with potential for breakout if momentum sustains above the $0.265 level.'

Market Sentiment: Mixed Signals Amid Record Open Interest and Profit-Taking

Dogecoin's market sentiment reflects a complex interplay of institutional interest and short-term volatility. Record open interest reaching $6 billion coincides with profit-taking activities following the recent ETF rally. BTCC financial analyst Emma notes, 'While institutional flows through ETF products provide structural support, traders are capitalizing on short-term gains, creating balanced pressure. The surge in long-term holder retention despite overbought conditions suggests underlying strength in DOGE's investment thesis.'

Factors Influencing DOGE's Price

Dogecoin Open Interest Surges to Record $6 Billion Amid Price Rally

Dogecoin's open interest has skyrocketed to an unprecedented $6 billion, marking its second all-time high this year. The meme coin's 20% price surge last week triggered a flood of investor activity, with open interest peaking at $6.01 billion on Sunday—eclipsing January's $5.51 billion record.

The milestone reflects intensifying speculative interest in DOGE, as traders pile into both long and short positions. Open interest data from Coinglass reveals this metric now stands at its highest level since November 2024's market-wide rally, despite missing previous benchmarks during May 2025's uptick.

DOGE's breakout past $0.30—a six-month resistance level—coincided with the open interest surge. Market observers note the parallel with January's pattern, when open interest plateaued despite subsequent price movements.

Dogecoin Retreats Amid Token Unlocks and Rate Cut Speculation

Dogecoin (DOGE) fell 4.7% over the past 24 hours, retreating from last week's rally fueled by expectations of Federal Reserve rate cuts. The meme coin's decline coincides with a broader crypto market pause as investors weigh inflationary token unlocks against macroeconomic optimism.

Nearly $250 million worth of digital assets—including 96.5 million DOGE ($27 million)—will hit markets this week. The scheduled releases from projects like Ethereum and Optimism create selling pressure, tempering enthusiasm from Thursday's cooler CPI data that cemented September rate cut bets.

As a sentiment-driven asset with no fundamental valuation anchors, Dogecoin remains hypersensitive to liquidity conditions. The Fed's impending decision now battles token supply inflation in a tug-of-war for DOGE's near-term trajectory.

Dogecoin Retreats After ETF Rally as Traders Take Profits

Dogecoin fell 4.4% in 24 hours amid profit-taking following last week's 11.5% surge, underperforming broader crypto markets. The pullback comes ahead of Thursday's launch of the SEC-approved REX-Osprey dogecoin ETF (DOJE), illustrating classic 'buy the rumor, sell the news' dynamics.

Despite the dip, DOGE remains the top performer among top-10 cryptocurrencies this week. Institutional interest continues to build, with corporations reportedly adding the meme coin to crypto treasury strategies - though analysts caution about its inherent volatility.

Crypto Analyst Urges Buying Dogecoin Dip as TD Sequential Signals Potential Rebound

Cryptocurrency analyst Ali Martinez (@ali_charts) sparked market activity with a bullish call on Dogecoin (DOGE), citing the TD Sequential indicator's buy signal. The technical tool, designed by Tom DeMark, suggests a possible trend reversal after recent price declines. Doge traded around $0.26 amid volatile conditions, with elevated spot and derivatives volume amplifying potential moves.

Market participants are closely watching DOGE's price action following recent U.S. ETF filings tied to the meme coin. These developments have fueled institutional interest and retail FOMO, contributing to heightened volatility. The TD Sequential's appearance comes as traders weigh technical factors against evolving market narratives around digital asset adoption.

Dogecoin Price Could See Another Double-Digit Surge This Week Amid ETF Launch and Institutional Interest

Dogecoin's price has surged nearly 38% this week, reaching $0.2963—its highest level in eight months. The rally follows news of the first U.S. Dogecoin ETF, the Rex-Osprey DOGE ETF (DOJE), set to debut soon. Institutional accumulation and retail enthusiasm are fueling the momentum.

The ETF's launch, structured under the Investment Company Act of 1940, signals regulatory credibility. Traders now watch for a breakout above $0.30, a threshold last tested during January's bull run. Dogecoin's resurgence underscores its enduring appeal as both a speculative asset and a mainstream crypto contender.

Dogecoin Breakout Signals Potential Rally to $1.70 Amid Short Squeeze Setup

Dogecoin (DOGE) has flashed a bullish technical signal following a 10% price drop, with the TD Sequential indicator printing a buy at $0.263. The meme cryptocurrency now shows a 1:29 risk-reward ratio on its weekly chart breakout, suggesting a potential surge toward $1.70 if the pattern holds.

Market dynamics appear ripe for a short squeeze as Open Interest climbs amid increasing short positions. The symmetrical triangle breakout on weekly timeframes—a pattern developing over several months—adds credence to the bullish case, though traders await confirmation through volume shifts or price action.

DOGE trades at $0.26 with $6.15 billion in 24-hour volume, down 10% daily but up 13% weekly. Analyst Ali Martinez notes the 4-hour chart's TD Sequential buy signal could pause the downtrend, while Trader Tardigrade emphasizes the long-term pattern's technical significance.

Dogecoin Surges 21% As Long-Term Holders Refuse To Sell Despite Overbought Signals

Dogecoin's liveliness metric has plummeted to 0.705, signaling that long-term holders are steadfastly retaining their positions even as the meme coin rallies. Glassnode data reveals a month-long decline in this metric, reflecting reduced selling activity among committed investors.

The Hodler Net Position Change metric tells a similar story, showing consistent accumulation since September 7. More coins are migrating to long-term storage wallets than hitting exchanges, creating supply constraints that typically precede sustained price movements. This conviction-led holding pattern mirrors historical bull market behavior.

Technical indicators suggest potential for DOGE to test $0.33, though the Money FLOW Index at 80.29 flashes warning signs of an overheated market. The current standoff between bullish accumulation and overbought conditions creates tension in DOGE's near-term trajectory.

Dogecoin Price Prediction: Chart Signals Explode – DOGE Targets $1 and Beyond

Dogecoin's price has retreated to $0.2643, marking a 7% drop in 24 hours despite recent gains. The meme token remains up 14% over the past week and 21% in two weeks, showcasing its volatile nature.

Technical indicators suggest potential near-term weakness. The RSI has cooled from overbought territory, while the MACD shows fading momentum. Profit-taking appears underway after DOGE nearly touched $0.30 last weekend.

Chart watchers note critical resistance at $0.33—a level last tested in January. A decisive breakout could propel DOGE toward its 12-month high of $0.466, with speculative targets stretching to $1.

Dogecoin Breaks Regional High, Analyst Predicts 300% Rally to $1

Dogecoin has surged past a key regional resistance level at $0.30 for the first time this year, sparking bullish predictions from analysts. Crypto strategist XForce projects a potential 300% rally toward the psychologically significant $1 mark, citing the breakout as confirmation of upward momentum.

While anticipating interim pullbacks, the analyst maintains that DOGE remains on track for new all-time highs. An alternative scenario outlined in accompanying charts suggests an even more ambitious trajectory—a potential climb to $18 if current bullish impulses sustain.

The weekend rally coincided with anticipation surrounding the REX-Osprey DOGE ETF, which WOULD mark the first institutional-grade investment vehicle for the meme coin. Market participants view this development as a potential liquidity catalyst, particularly with the Federal Reserve's anticipated rate cuts looming.

Dogecoin Bulls Eye $0.54 ‘Final Boss’ Breakout, Says Top Analyst

Dogecoin stands at a critical technical threshold, with crypto analyst CantoneseCat (@cantonmeow) identifying $0.54 as the make-or-break level. A weekly close above the Ichimoku cloud could signal the start of a sustained upward trend.

The meme coin's steady consolidation, supported by higher-timeframe indicators, suggests underlying strength. Monthly charts show DOGE respecting the 20-month moving average—a historical launchpad for rallies—while weekly charts highlight persistent demand despite resistance.

"I am bullish on Dogecoin," CantoneseCat noted, dismissing bearish concerns. The Ichimoku cloud now acts as both a barrier and a potential springboard, with Bollinger Band alignment reinforcing the case for momentum.

Is DOGE a good investment?

Based on current technical indicators and market developments, DOGE presents a compelling investment opportunity with measured risk. The cryptocurrency trades above its 20-day moving average while showing strong institutional interest through record open interest and ETF inflows. However, investors should consider the following factors:

| Factor | Current Status | Investment Implication |

|---|---|---|

| Price vs. 20-day MA | $0.2649 vs. $0.2374 | Bullish momentum |

| Bollinger Band Position | Near upper band ($0.2879) | Potential overbought condition |

| Open Interest | $6 billion record | Strong institutional participation |

| ETF Developments | Recent launch and interest | Structural support |

BTCC financial analyst Emma suggests: 'DOGE offers asymmetric upside potential, particularly if it breaks through the $0.54 resistance level. Investors should consider dollar-cost averaging and maintain position sizing appropriate for crypto's inherent volatility.'